About Us

A Financial Partner for First Responders & Veterans

Michael E. Barnes Sr.

Michael E. Barnes Sr. is more than just a financial expert—he is a first responder, military veteran, and financial strategist committed to helping those who serve.

With 23 years of military experience between the Marine Corps and Army, as well as 15 years in law enforcement, Michael saw firsthand how financial education and planning are often overlooked in service professions. After working with major banks, investment firms, and insurance companies, he decided to build a firm that put first responders and veterans first.

- Assisting in financial planning, wealth management, and investment strategies

- Focusing in tax-efficient strategies and business growth for service professionals

- Advocating for veteran and first responder financial education.

- Helping thousands looking to take control of their financial future.

Michael understands the sacrifices, financial challenges, and opportunities that come with a career in service. His goal is to empower first responders and veterans with the financial tools and knowledge they need to build lasting wealth, secure their future, and make confident financial decisions.

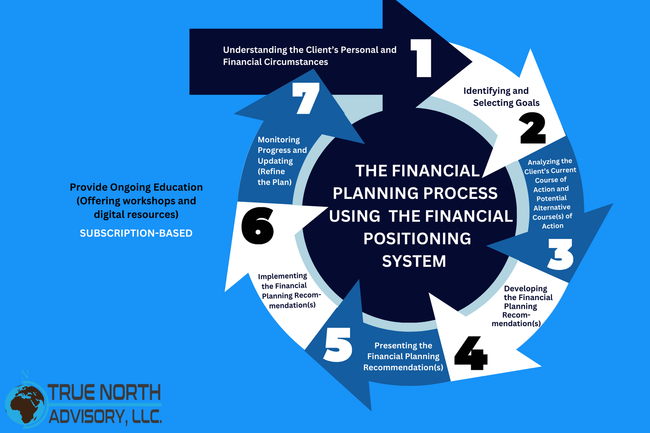

Our Approach

A Team Committed to Your Success

True North Advisory takes a holistic, personalized approach to financial planning, ensuring that every client receives:

- Customized financial plans based on their career, benefits, and long-term goals

- Tax-efficient wealth-building strategies designed for service professionals

- Ongoing education through workshops, bootcamps, and digital resources

- Accountability tracking and digital tools to keep clients on course

Unlike traditional financial firms, we don’t just offer services—we build relationships. Every financial strategy we create is designed to support the

unique needs of those who dedicate their lives to service.

Our Mission & Purpose

To provide comprehensive financial guidance tailored to the needs of military personnel, first responders, and service professionals, ensuring they have a path to financial security and long-term wealth.

Our Core Values

Decades of Experience, One Shared Mission

- Service First

We serve those who serve others. Our approach is built around integrity, transparency, and putting clients first. - Financial Education

We believe in empowering clients with knowledge, not just selling financial products. Education is at the core of everything we do. - Accountability & Personalized Guidance

Through financial guidance, structured goal-setting, and accountability tracking, we ensure every client has a clear path forward. - Innovation & Modern Solutions

We leverage cutting-edge financial tools, including our financial planning app, to help clients track their goals and make smarter financial decisions. - Long-Term Relationships

Financial guidance isn’t a one-time event—it’s a lifelong partnership. We are committed to guiding our clients through every stage of their financial journey.

Your Financial Journey Starts Here

True North Advisory is more than a financial firm—it’s a mission. A mission to help first responders, military personnel, and service professionals take control of their financial future, build wealth, and create lasting security for themselves and their families.

This is your opportunity to work with a financial partner who understands your career, your challenges, and your goals.

Who We Serve

Tailored Financial Strategies for Every Stage of Life

Military Veterans

Transitioning from military life to civilian life comes with unique financial challenges. We help veterans maximize their military benefits, optimize pensions, and create long-term plans for retirement, education, and wealth-building. Whether you're entering the workforce, starting a business, or planning for retirement, we’ll guide you through every step.

Active-Duty Service Members

Financial Readiness for Life in Uniform

Active-duty military life requires flexibility and financial preparedness. We specialize in helping service members navigate:

Thrift Savings Plan (TSP) management

Deployment-related pay considerations

Military tax benefits and exemptions

Family and survivor financial planning

Our goal is to help you create a financial plan that supports your career and your family’s future, no matter where service takes you.

Law Enforcement and First Responders

Protecting Those Who Protect Us

As a law enforcement officer or first responder, your focus is on keeping others safe—we focus on protecting your financial future. We help:

- Maximize public service pensions and benefits

- Plan for early retirement options and DROP plans

- Manage stress-related financial challenges unique to the field

- Protect your family with tailored insurance and estate plans

We’ll help you build a financial plan that supports today’s needs and tomorrow’s goals.

Firefighters, EMTs, Paramedics

Building Financial Security for Life’s Unpredictability. Emergency responders face unique challenges—irregular hours, high-risk environments, and unpredictable schedules. We help you:

- Optimize pensions and retirement savings

- Implement tax strategies to maximize income

- Set up insurance policies that reflect job risks

- Create a financial safety net for your family

With a solid financial plan, you can focus on your mission, knowing your family’s future is protected.

Government Security Employees

Strategic Financial Planning for Federal & Private Security

Whether you're working in homeland security, cybersecurity, intelligence, or private defense, government security employees have complex financial needs. We offer:

- Specialized retirement planning (FERS, CSRS, and TSP optimization)

- Clear guidance on security clearance-related financial concerns

- Wealth management and tax strategies for high-income earners

- Estate planning to protect sensitive assets

Our goal is to provide financial clarity and security, so you can focus on safeguarding others.