Business & Wealth Growth for Veterans & Entrepreneurs

Financial Strategies for Veteran-Owned Businesses & Entrepreneurs

Empowering Your Financial Future

Many veterans and first responders transition into business ownership or self-employment after service. At True North Advisory, we help entrepreneurs, self-employed professionals, and business owners build sustainable wealth and protect their assets with smart financial planning.

We understand the unique challenges of veteran entrepreneurs—from securing startup capital to optimizing taxes and building long-term wealth. Our business financial planning solutions provide clarity, structure, and a clear path to success.

Key Components of Our Business & Wealth Growth Services:

- Business Funding Solutions: Access business loans, grants, and investment capital for startup or expansion.

- Wealth Accumulation Strategies: Build passive income streams, investment portfolios, and long-term wealth strategies.

- Tax Planning for Entrepreneurs: Reduce business taxes and structure financial plans for maximum savings.

- Retirement & Investment Planning for Business Owners: Ensure business owners have structured retirement accounts for long-term security.

- Asset Protection & Risk Management: Implement business insurance, liability protections, and estate planning to secure your financial future.

Why Work With True North Advisory?

- Specialized Experience: We understand the challenges veteran entrepreneurs face when building wealth and running a business.

- Business & Personal Finance Integration: Our holistic approach ensures both your business and personal financial goals are aligned.

- Proven Wealth-Building Strategies: We help maximize business income, tax efficiency, and investment growth.

What’s Included in Your Business Financial Plan?

Business Funding & Credit Strategies

Secure capital and optimize cash flow.

Wealth-Building Strategies

Create passive income, investment portfolios, and business equity growth.

Tax Optimization for Business Owners

Reduce tax liabilities and structure business finances effectively.

Asset Protection & Risk Management

Safeguard your business and financial future.

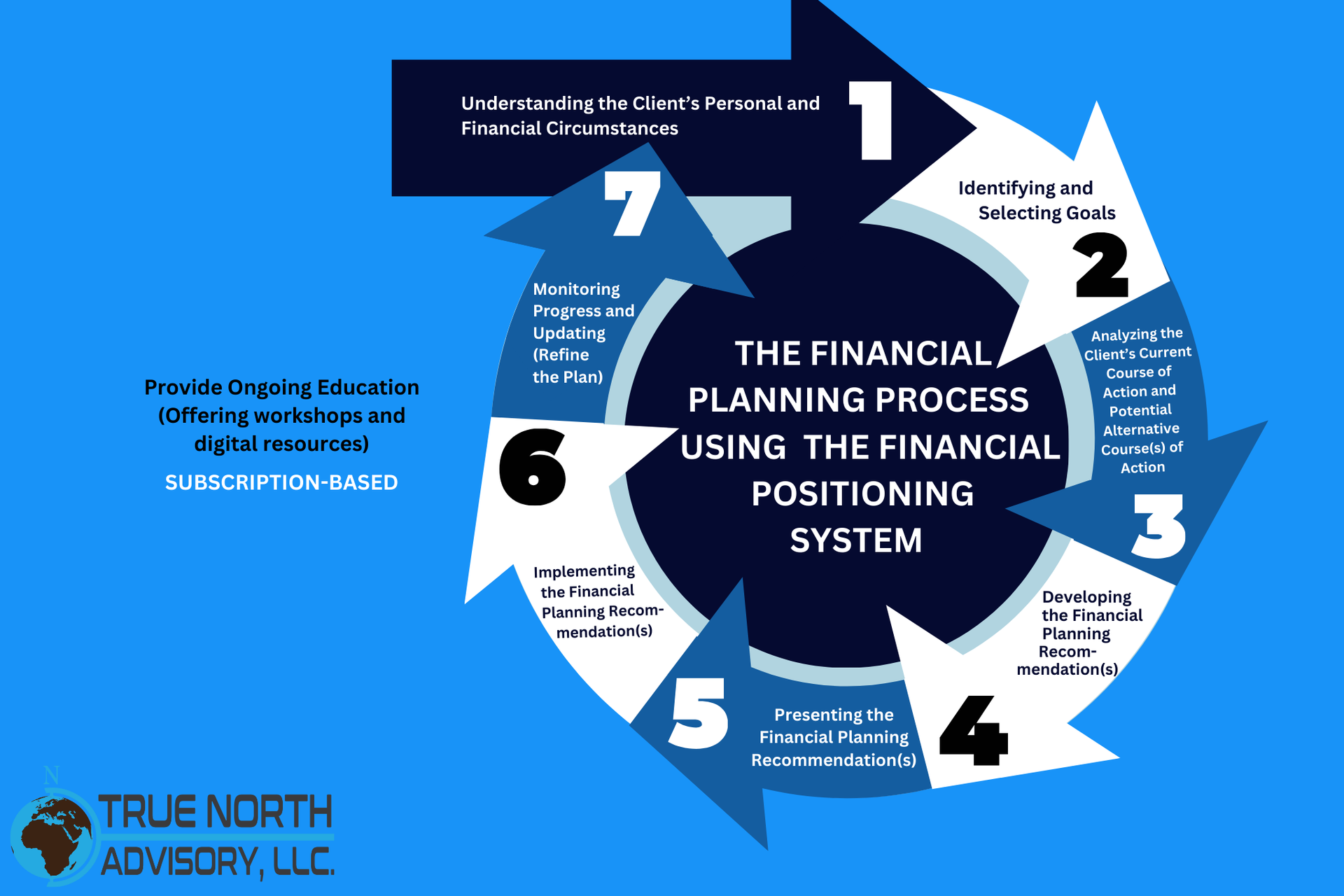

Our Business & Wealth Growth Process

How We You Build Wealth as a Business Owner

- Business Evaluation: Assess your business model, financial standing, and income streams.

- Strategic Planning: Develop a wealth-building and business financial roadmap tailored to your goals.

- Implementation & Growth: Execute strategies to increase revenue, reduce taxes, and expand investment opportunities.

- Implementation: Executing your plan with clear, actionable steps to optimize retirement income and asset growth.

- Ongoing Support & Adjustments: Ensure long-term success with continuous financial adjustments and business strategy refinements.

Common Questions About Business & Wealth Growth

How can I fund my veteran-owned business?

We assist with securing business loans, investment capital, and grants for veteran entrepreneurs.

How do I build wealth beyond my business?

We provide strategies for passive income, stock market investments, real estate, and diversified wealth growth.

What tax advantages do veteran business owners have?

We help leverage tax deductions, credits, and business entity structures to maximize savings.

Start Growing Your Business & Building Wealth Today

At True North Advisory, we provide expert financial guidance for veteran entrepreneurs and self-employed professionals. Whether you’re launching a business, scaling growth, or preparing for long-term wealth, we’ll help you build a strong financial future.