Financial Planning for First Responders & Veterans

A Strategic Plan for Your Financial Future

Empowering Your Financial Future

At True North Advisory, we recognize the unique financial challenges faced by first responders and military veterans. Our comprehensive financial planning services are designed to address these specific needs, providing a roadmap to financial security and success.

Key Components of Our Financial Planning Services:

- Personalized Financial Assessment: We begin with a thorough evaluation of your current financial situation, including income, expenses, assets, and liabilities. This assessment forms the foundation of a customized financial plan that aligns with your goals.

- Debt Management Strategies: Understanding the pressures of debt, we offer strategies to reduce and manage debt effectively, freeing up resources for savings and investments.

- Savings Plans: We emphasize the importance of disciplined saving habits, helping you establish emergency funds and long-term savings plans to safeguard your financial future.

- Investment Guidance: Our advisors provide insights into investment opportunities that align with your risk tolerance and financial objectives, ensuring a balanced and diversified portfolio.

- Insurance Solutions: Protecting your loved ones is paramount. We assess your insurance needs and recommend appropriate coverage, including life, disability, and critical illness insurance.

- Retirement Planning: Leveraging military retirement benefits and other resources, we help you set realistic retirement goals and develop strategies to achieve them.

Why Choose True North Advisory?

Our team comprises professionals with firsthand experience in military and first responder communities. This background enables us to provide relevant and effective financial advice tailored to your unique circumstances.

What’s Included in a Financial Plan?

Our comprehensive financial planning services cover all aspects of your financial life to help you build, grow, and protect your wealth.

Retirement Planning

Ensure long-term financial security with a structured savings and income strategy

Investment Planning

Build a diversified portfolio that aligns with your risk tolerance and goals

Tax Planning

Optimize your tax strategy to reduce liabilities and maximize savings

Insurance & Risk Management

Protect yourself and your family with customized insurance solutions

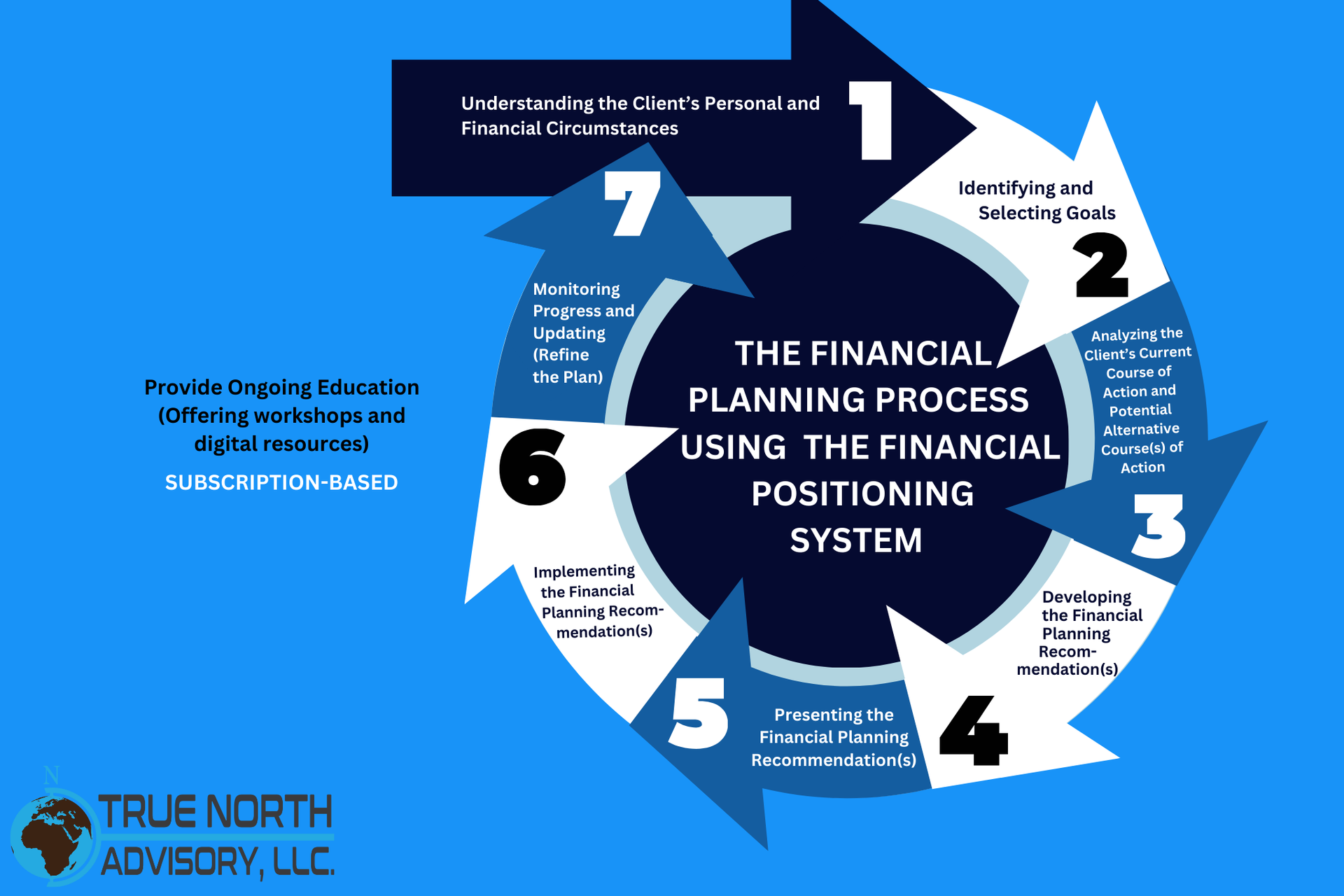

Our Financial Planning Process

We believe financial planning should be simple, structured, and stress-free. That’s why we take a methodical approach, helping you navigate each stage of your financial journey.

How We Build Your Financial Plan

- Discovery: Understanding your current financial situation, priorities, and long-term goals

- Personalized Asset Map: Visualizing your financial landscape so you can see where you stand

- Customized Strategy: Creating a plan that covers retirement, investments, tax planning, and insurance

- Implementation: Putting your financial plan into action with clear, actionable steps

- Ongoing Support & Adjustments: Reviewing and refining your plan as your needs evolve

Common Questions About Financial Planning

How is financial planning different for first responders and veterans?

Financial planning for first responders and veterans requires an understanding of unique benefits, pensions, and career risks. At True North Advisory, we specialize in strategies tailored to:

- Military & Government Pensions (TSP, FERS, and pension buybacks)

- Disability & Veterans Benefits (VA compensation, SSDI, and survivor benefits)

- Service-Related Tax Benefits (combat pay exemptions, tax-free disability compensation)

- Job Transitions & Retirement Planning (military-to-civilian financial shifts)

When should I start financial planning?

The best time to start was yesterday—the next best time is today. Whether you’re a new recruit, mid-career professional, or nearing retirement, financial planning can help you optimize your income, investments, and benefits.

Can financial planning help me get out of debt?

Yes. Debt is a major challenge for many service members and first responders. We help clients:

- Reduce high-interest debt efficiently

- Implement budgeting tools for better cash flow management

- Leverage VA & state programs for financial relief

Can you help me transition to civilian financial life?

Absolutely. Military and first responder careers come with financial transitions that many traditional financial advisors don’t fully understand. We assist with:

- Post-service job and income planning

- Business & entrepreneurial financial coaching

- Navigating changes in insurance, taxes, and benefits